Chapter 4COMPETITOR CONTENT ANALYSIS

Scrutinising competitor content is beneficial for a whole host of reasons, including:

- Spotting opportunities for quick wins.

- Identifying what hasn't worked for them and should be avoided.

- Highlighting gaps in the market you can position yourself as an expert in.

- Detecting topics competitors are already considered experts in and are therefore best sidestepped.

When analysing their content, ensure you include pieces of all levels; from large scale interactive campaigns, to blog posts.

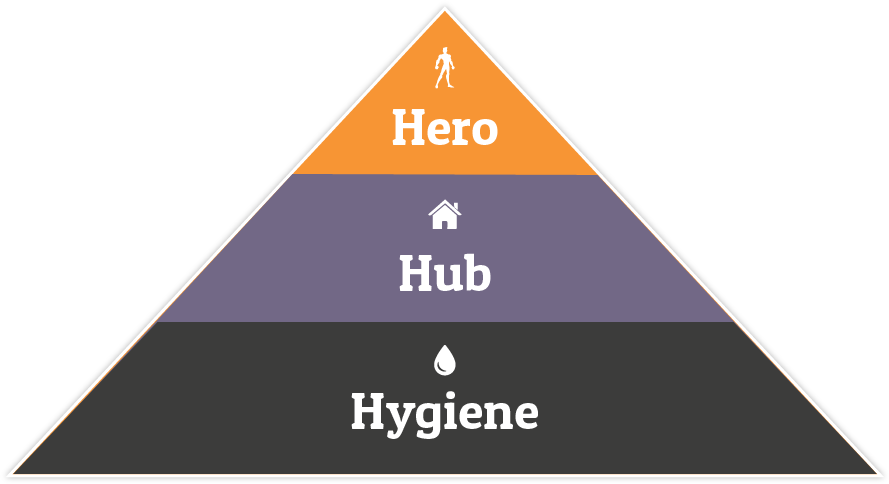

The hero, hub and hygiene concept – coined by YouTube within their playbook – applies nicely to content and provides a useful definition of the types.

Hero

Day-to-day content produced to appeal to your target audience and keep them engaged, e.g. blog posts.

Hub

Regularly pushed, but slightly larger, content pieces aimed to educate or entertain your demographic, like guides or 'how-tos.'

Hygiene

Large scale content pieces, used to raise brand awareness and bring in new leads, including Infographics or interactive pieces targeted at a wider audience.

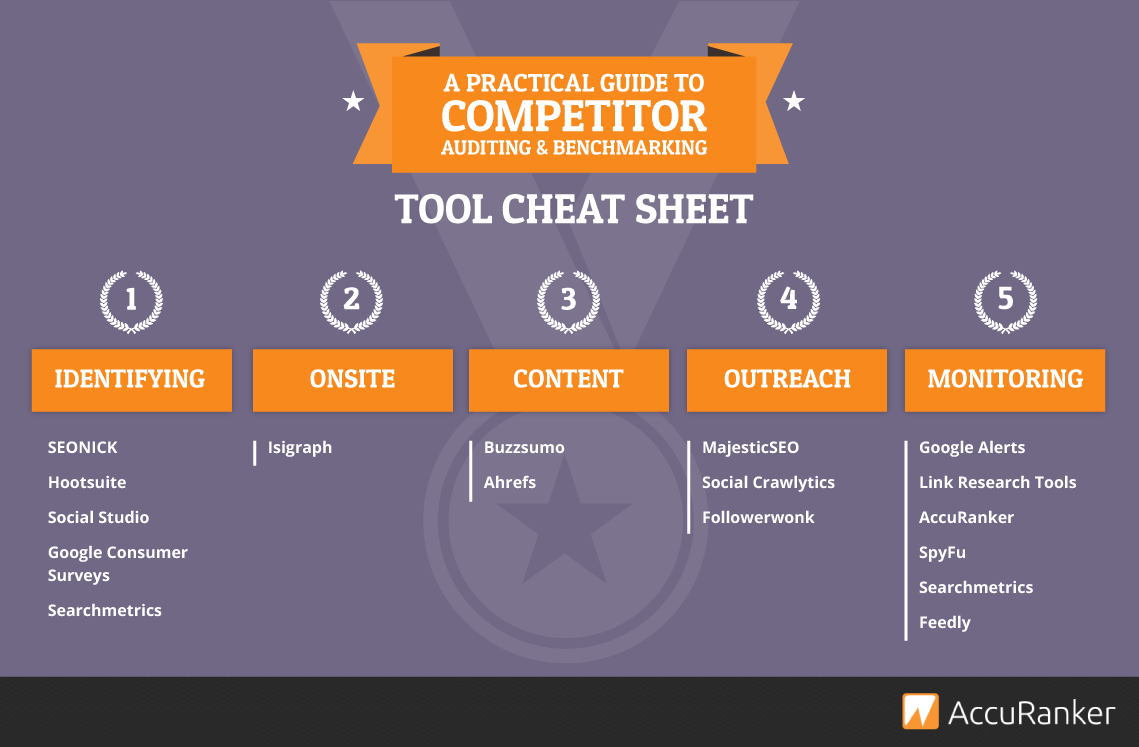

Useful Tools

The thought of manually trawling blog posts, infographics, guides, etc. to identify your rivals' strongest – and weakest – content is exhausting. Fortunately, these tools will help shave valuable hours off the process.

Buzzsumo allows you to identify the most shared content across social, locate influencers and receive content alerts.

Additionally, by inputting your competitor’s URL, you can identify their most socially shared articles, ordered by popularity.

Ahrefs not only helps you find newest links to any piece of content, but also recently launched a Content Explorer which allows you to find most shared content across multiple networks.

We find it complements BuzzSumo very well in research stages.

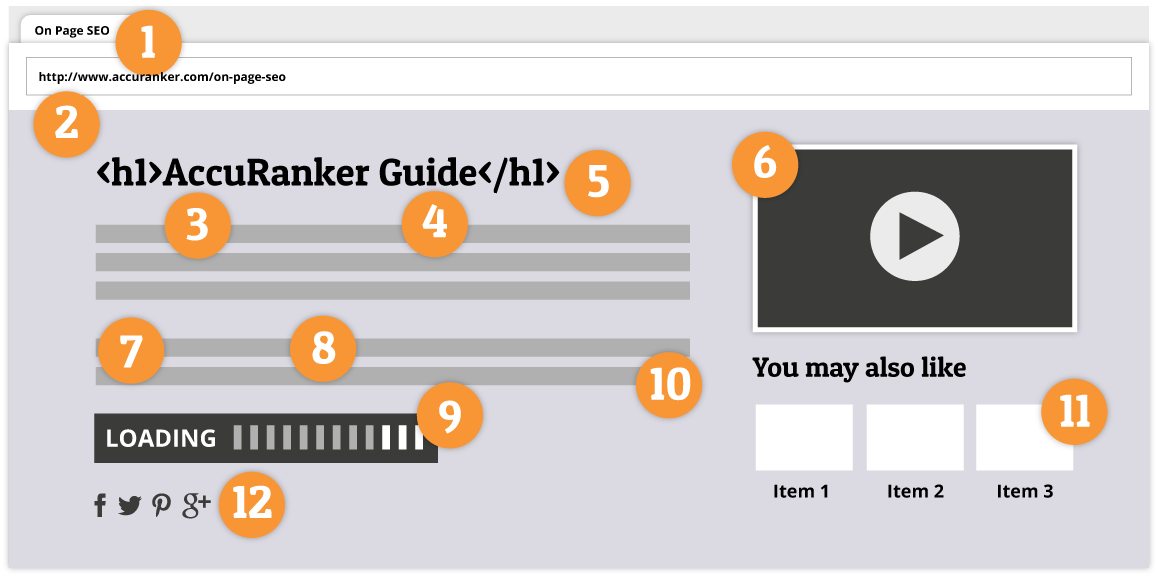

Now that you have a list of the most shared and linked to pieces of hygiene, hub and hero content, you need to note strengths and weaknesses.

When analysing a competitor's best performing pieces in more depth, consider the following questions:

- What type of content is it?

- What is the purpose of this content? (E.g. Brand awareness, leads, visits).

- How shareable is it?

- Is it gated? (I.e. Do users have to enter an email address/other info to access it?)

Download our checklist of the above to help structure your competitor content analysis.

Chapter 6COMPETITOR SOCIAL MEDIA ANALYSIS

When benchmarking against your competitors, analysing their social channels will prove insightful; allowing you to confirm their strongest - and weakest – points.

Determine which channels they're active on, then scrutinise their pages, considering the below:

Use our template to log progress for each of their channels.

Consider their strengths and weaknesses and turn them into tips and quick wins that can be implemented into your own social strategy.

Share this chapter: